B2B businesses are no stranger to late payments. SMEs in Malaysia struggle the most with this as 60% of commercial payment collection periods exceed the credit terms. Late payments and outstanding invoices are the grim reality for many businesses – but it doesn’t have to be the case.

If you are constantly waiting and chasing clients for outstanding payments, it can eat into your cash flow and impact your business’ ability to grow. Late payments are one of the main reasons SMEs struggle to scale – and with no regulations in place to intervene, you have to take matters into your own hands to protect your business.

Stop Manually Handling Outstanding Payments

Sales representatives would be all too familiar with the downside of manual payment tracking. Chasing payments is a day-to-day responsibility for the sales force, taking up valuable time that could be spent on more pressing matters.

If you have one or two clients, it is still manageable. But as you scale and start having more clients, it can get messy – especially if you’re stilll using pen and paper for documentation. To get ten clients to pay, you have to call them up individually, manually sifting through invoices and contact lists to get the information you need and consolidating new data from multiple sources.

It doesn’t stop there. You still have to do follow-ups, client by client, costing more time and resources in the long run. There is also the issue of credit management – you have to manually monitor your customers’ scorecards and keep up with different payment terms.

With these setbacks, your cash flow will be disrupted – the cash you need for capital and ongoing expenses. At the same time, your sales representatives will have less time to make actual sales because they are too busy making sure invoices are paid.

While late payments are part and parcel of the business, you can resolve them faster with better processes and automation systems in place.

Switch to an Online E-commerce Solution

How can you reclaim that valuable time? By investing in an online e-commerce solution to manage all your orders and automate the payment process.

A platform like Dropee Direct allows you to sell online, manage inventory and track orders in real-time!

With robust tools that automate processes like generating invoices, updating payment statuses and collecting payments, you can free up time for more important tasks. At the same time, all of the data is stored in one place, making it easy for you to stay on track.

Ditch Manual Processes

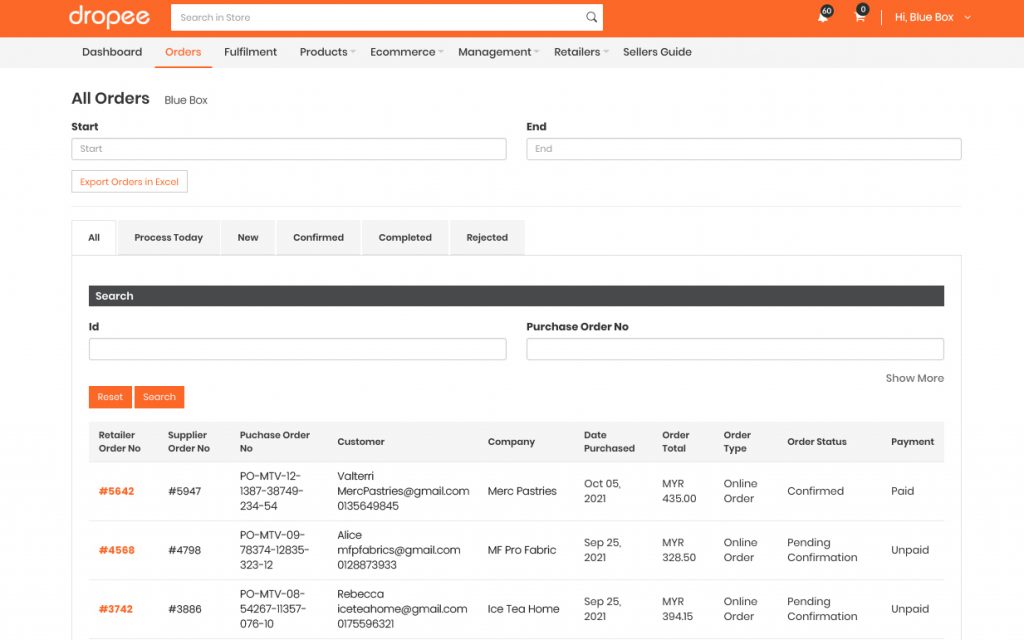

On Dropee Direct, you can eliminate the need for manual processes completely. When your customer places orders, they are automatically segmented by their statuses, such as Process Today, Confirmed and New.

You get a full overview of these orders by segment on your dashboard, giving you instant updates on the progress of each order and which ones you need to take action on. If your sales representative needs to follow up with a client on a payment, they can easily find the exact order on the dashboard.

There’s no need to file through messy paperwork and hunt for a client’s number anymore – everything is easily organised for you to get all the information you need to follow up accordingly!

Keep Track of Outstanding Payments

Late payments are almost unavoidable in B2B, but you can keep them to a minimum with more precise tracking and enhanced visibility. If you are still doing things manually, most of your time would be spent tracking down individual invoices and updating payment statuses. This means you spot late payments even later and start taking action too late.

With Dropee Direct, you’ll have enhanced visibility and automatic updates on order statuses, which allows you to pre-empt for possible late payments and address them in time. You can also leverage the data you have to spot patterns in your customers’ paying habits and find a solution for recurring late payments.

The information you gain from tracking payments over time allows you to curate strategies and promotions to protect your bottom line in the long run.

Automate Manual Processes with Dropee Direct

Automation is the remedy for late payments, which have plagued SMEs for too long and held them back from growth. The ability to track your orders and payment statuses in real-time and from one place can help you minimise late payment and earn you more time for critical tasks.

Get in touch with us here to see Dropee Direct in action how we can help your business digitise seamlessly!