What does fundraising look like in a Covid-19 world?

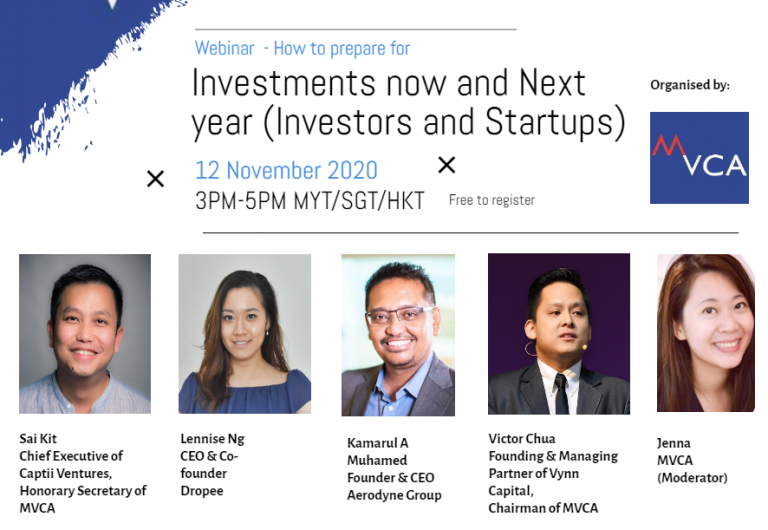

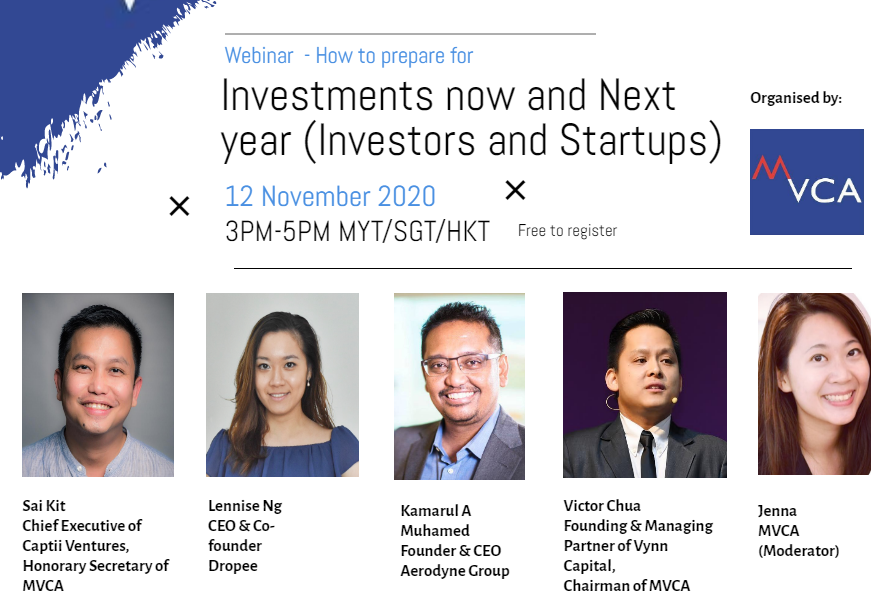

That was the objective of How to Prepare for Investments Now and Next Year, a webinar organised by MVCA, a venture capital company in Malaysia.

Moderated by Jenna (MVCA), the webinar sheds light on how businesses can prepare for investments in the coming years – both from an investor’s and a startup’s perspective.

Lennise Ng, CEO and co-founder at Dropee, shared key insights in fundraising from a startup’s standpoint, alongside Kamarul A Muhamed (Aerodyne Group), while Sai Kit (Captii Ventures, MVCA) and Victor Chua (Vynn Capital, MVCA) focused on the investor’s point of view.

“With or without a pandemic, you need to show your traction… If you run any business, you have to include sustainability.”

Lennise Ng, CEO and co-founder at Dropee

There is No Slowdown

Due to the ongoing pandemic, investors today are more cautious – and it also doesn’t help that deal flows have to happen online via Zoom or Google Hangouts, which adds complexity to the process.

But it doesn’t mean that investors aren’t investing.

“There is a slowdown, and there is a longer due diligence that investors will go through, but there is no drying out,” says Lennise. To her, what’s more important is proving your company’s value to the investor.

“At the end of the day, with or without a pandemic, you need to show your tractions. You have to provide more relevant information for the investors to make that decision, to give more confidence, and to show that you are value adding to the ecosystem that they want to grow.”

Kamarul from Aerodyne Group agrees, and reiterates the point of having a strong conviction. “You need that clarity, you need that focus, you need that tenacity – irregardless of a pandemic. It’s easy to sell your idea if you have conviction.”

So, what should startups do?

Key Tips for Fundraising This Year

“For investors to invest money, it’s all about strategy,” says Victor from Vynn Capital.

And to prepare for that strategy, a clear roadmap is important.

“Build a strategy on how to tackle it,” advises Lennise. “It doesn’t work if you call up VCs or investors tomorrow. What you ought to do is study the market, do your due diligence, figure out which VCs are a good fit for you and your company, and if they can take you to greater heights.”

She also reminds startups to be very clear on who they want to raise from, as bringing in the wrong investors will do more harm than good.

“Ask yourself, do they have expertise or experience in the industry? Do they have experience helping other entrepreneurs grow?”

Key tip from Lennise on performing due diligence: Do the hard groundwork. Figure out who this VC is, what this investor has invested in, and take a look at their portfolios. Talk to people who have worked with them before. If you have a network, tap on it and get their input.

How to Prepare for Next Year?

“If you run any business, you have to include sustainability, whether you’re raising or not,” says Lennise.

Sai Kit echoes this sentiment. For an investor, sustainability is crucial. “Be very clear about how this pandemic has affected the business,” he adds.

“Will the growth outlast the pandemic? Just because there’s a surge in demand, it doesn’t give you a golden ticket to embark on a unicorn journey.”

Investors always play the long game, and business owners who are looking to fundraise must have a long-term vision as well. Staying true to your vision, and not deviating from the goalpost is key. Victor puts it eloquently: “We’re looking at years, not months.”

For Dropee, building a sustainable business is always top priority.

“We are in the midst of creating more products to provide more value to our clients and our customers,” says Lennise. “How are we fundraising? We’re connected to VCs, locally and internationally, and we’re preparing for that.”

A key tip from Lennise on pitching: Get feedback! Fundraising isn't talking to one or two VCs and immediately locking them in. It's talking to hundreds of VCs and only getting one or two yeses. It's a marathon, so keep going at it, always ask for feedback, and keep learning how to improve. When a VC says no to you, ask why. Figure out what didn't work out - was it bad storytelling, missing key information, or a specific number you have to hit?

Opportunities Are Abundant

The panelists are hopeful for the future. Even though Covid-19 has changed the entire business landscape, it has also presented opportunities for startups to tap into.

As Victor says, “there are opportunities in the local market,” and startups should first solve problems locally. “Being sustainable and being strategic, that’s the best playbook.”

Parting advice from Lennise?

“Knock on a lot of VC’s doors, and don’t be afraid to fail!”

Click here to watch the full webinar on How to Prepare for Investments Now and Next Year.