Has your business began charting the path to recovery?

Covid-19 thrust the world into disarray but it also created opportunities for transformation. It accelerated digital transformation on a global scale, and customers quickly turned to e-commerce to source for products and services. Soon, businesses followed suit.

To continue serving existing customers and attracting new ones, businesses across various industries transitioned to a digital space. This shift, according to Maxis, has led to Malaysia’s e-commerce market exceeding USD$3 billion in 2020. This figure is expected to reach USD$ 11 billion in 2025.

The focus here is no longer on survival strategies – it is the new norm.

Now is the time for B2B players to leverage new pathways and elevate their e-commerce strategies.

Businesses who tailor their digital efforts to meet customer demands for greater connectivity, personalisation and efficiency will reap the benefits of the digital economy.

Our article looks at five key areas to improve on as part of your business’ Covid-19 recovery plan.

Optimise Your Business with Digitally-Enabled Payments

Digital payments have skyrocketed since Covid-19. A result of Malaysia’s accelerated e-commerce development, combined with changing consumer behaviours, has set the tone for the growth of digital payments.

Businesses who previously resisted digitisation’s call were forced to take their operations online – which impacted the method of payment.

According to the Maxis report, 70% of Malaysians now prefer merchants who offer digital payment over those who offer cash. Research from ACI and YouGov also revealed that 32% of Malaysians have reduced or completely stopped credit or debit cards and cash since the pandemic and 45% now use digitised real-time payment (RTP) methods.

Rapid advancements in technology have led customers to expect mobile-first, digitally charged experiences that allow them to make payments, settle bills and transfer money instantaneously.

In your recovery plan, here are some of the ways you can improve your digital payment offerings:

- Reducing the number of steps during the payment journey. Simplifying the payment process for your customers will improve overall customer experience and reduce cart abandonment rates. This also includes minimising the number of page redirects during the payment process.

- Ensuring compatibility across various devices. Anticipate that your customers will use different browsers and device types when making payment. Take steps to reduce potential barriers by standardising your payment solutions across all platforms.

- Prioritising your customers’ safety. Prevent security threats by ensuring that all necessary safety measures are put in place. Implement one-time passcodes for more secure transactions and invest in risk analytics software to help prevent fraud.

- Educating your customers. Though digital payment solutions are trending, there are still traditional B2B customers who are apprehensive. Educate about the security features and convenience of digital transactions and build their trust and confidence.

- Using QR codes. Thanks to its touchless payment technology, QR codes have been essential in reducing contact. More payment companies are beginning to offer this to improve efficiency and provide customers with safer in-person payment options.

Level Up on Shipping and Delivery

Seamless and efficient delivery services are the backbone of e-commerce success and in a hyper competitive market, merchants are scrambling to offer speedy deliveries to triumph over their peers.

Businesses are no longer playing in an arena where 3-day delivery reigns supreme. Driven by high consumer expectations, more B2B retailers are looking into upgrading their delivery time to include next-day or same-day delivery options at affordable price points.

Buyers want instant gratification. LinkedIn revealed that millennials are twice as likely to expect same-day delivery for online orders and that 46% of them are willing to pay more to get their items on the same day. Data from local logistics provider According to Lalamove, 25% of Malaysian customers are willing to fork out a premium for same-day delivery.

On top of fast delivery times, customers also have higher expectations when it comes to delivery transparency.

Businesses that respond to these needs will see greater loyalty from customers that prioritise meaningful, long-term relationships.

Continue to Improve the Customer Experience

To win customers, it takes more than just the best pricing. Today’s B2B customers want seamless and convenient shopping with the same degree of personalised service.

When shopping online, customers want accessible product information, easily identifiable stock status and a smooth shopping experience. This means that websites need speed, clarity and seamless navigation. Product reviews and user testimonials are also a major plus point.

In your recovery plan, be sure to:

- Identify your key customer profiles. Knowing who your customers are and what they value will let you craft experiences that resonate.

- Businesses can gain insight into this through customer satisfaction surveys or by speaking to your sales team.

- Pay attention to how your customers want to interact. Some customers may want to receive regular updates or want access to 24-hour customer support.

- For example, customers who are using software provided by a vendor or equipment require regular maintenance. Others, such as cafes or grocery stores may only want to communicate when it’s time for a restock.

- For either scenario, knowing what your customer interactions look like can help you decide how to structure your customer services, and determine the best communication channels to use.

- Strike a balance between your analog and digital services. A supplier of automobile parts may assign account managers to service their larger clients (car servicing centres with multiple outlets), while directing their smaller customers (neighbourhood mechanics), to their website to replenish their stock online.

- Finding a way to balance out both the digital and analog features of your business will give you the best of both worlds.

Adopting An Omnichannel Approach in Your Recovery Plan

Connecting online and offline can help create cohesive customer interactions, build greater brand awareness and target a wider audience.

Customers frequently use both channels. They cross these two borders to conduct research, compare products and services before they make a final purchasing decision. Businesses that are able to engage with them across both touchpoints will level up on their retention.

Managing your online and physical channels separately creates conflict, and isn’t true to how customers shop today. The goal is to devise an omnichannel recovery strategy that flows well between all of your sales avenues.

For example, imagine you’re a paper products supplier currently running a promotion on recycled paper bags. Your customer – a gift shop owner – comes across this promotion on your Facebook page and visits your website to make a purchase. Upon checking out, he sees that you provide an option for same-day, in-store pickup at your physical outlet. Since his shop is located in the same neighbourhood as your store, he selects this option so that he can collect his order on his way to work.

In the above example, all of your sales touchpoints work together to create a seamless and complementary shopping experience. There is no loss of customer visibility or sales. This is the omnichannel experience – it closes the gap between online research and in-store purchases and allows your channels to work together.

Harness the Power of Data

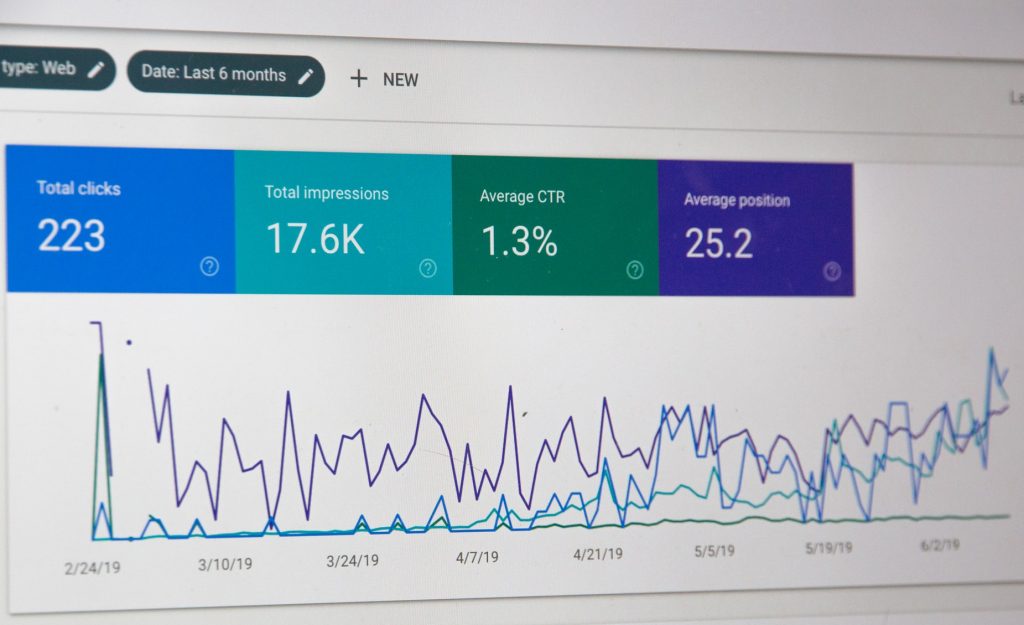

With e-commerce at the forefront of Malaysia’s economy, a growing number of businesses are beginning to leverage big data analytics and the IDC predicts that Malaysia’s big data market will grow to USD$1.9 billion by 2025.

The call for personalisation is nothing new. Research shows that 80% of customers are more likely to buy when stores offer personalisation. Having the right data on hand can help you segment and target your customer groups accordingly, and you can then easily provide them with the right content, offers and shopping experiences.

Your data can also help you define realistic goals when it comes to finances. Historical data can help you better understand the financial health of your company and help you make informed decisions.

According to Isaac Jacob, Managing Director of Malaysian big data analytics company Fusionex International, “Using such data, businesses can undertake analyses that can lead to action, such as upselling or cross-selling or more targeted marketing. Moreover, they can leverage predictive analysis to make better decisions and exploit opportunities.”

Data is one of the highlights of going online. From accelerating growth to determining what steps to take, the data you collect can help you manage your resources and map out your long term recovery plans.

Navigating Beyond the New Normal

The path to recovery has its fair share of challenges but in the last 18 months, amidst extended lockdowns and changing SOPs, businesses have repeatedly proven their resilience.

As the economy re-opens and restabilises, e-commerce will present businesses with a window of opportunity to elevate their customer engagement, boost sales and streamline operations.

Dropee’s solutions can provide B2B businesses at various stages of the digital adoption cycle to move online quickly and easily by helping you set-up your online store. Book a demo with our sales team and kickstart your digitisation journey!