Every business strives for growth, and GMV plays a key role in measuring it. The GMV meaning extends far beyond surface-level sales data; it is a reflection of your business’s overall performance and growth. Knowing how to interpret and utilize GMV can set you apart in a competitive market.

In the following sections, we’ll explore how to calculate GMV, its influence on business strategies, and why it’s so vital for future growth. By the end, you’ll have a better understanding of how GMV can be a driving force behind your business’s expansion and profitability.

GMV Meaning Explained: A Key Metric for E-Commerce Growth

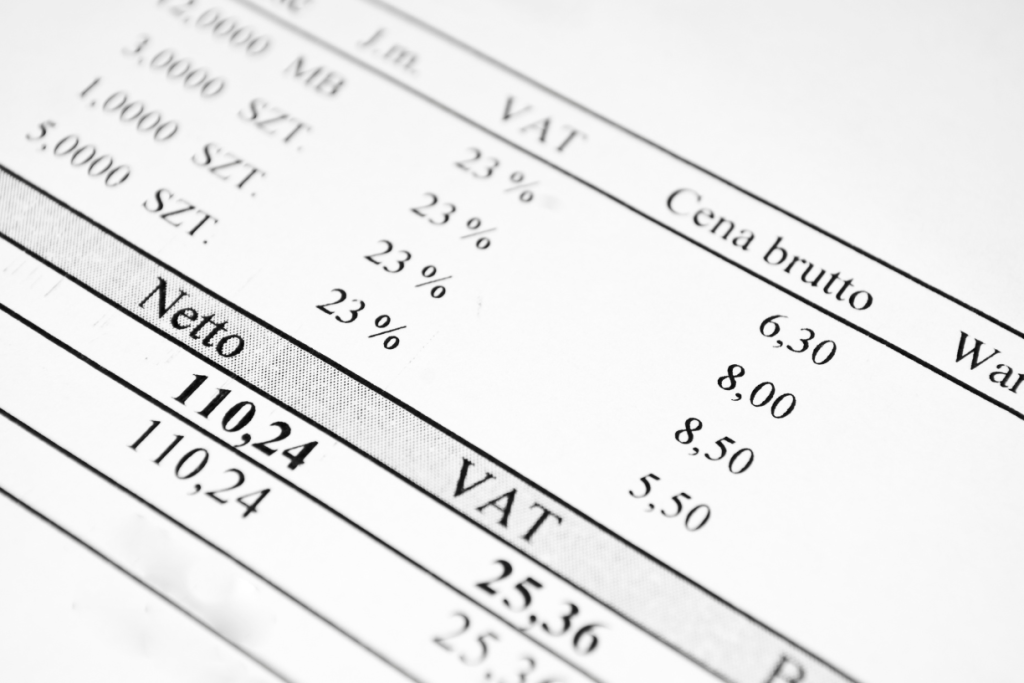

GMV (Gross Merchandise Value) refers to the total value of goods sold over a specified period through a customer-to-customer exchange platform. It is a metric used to measure business growth or valuation. According to Investopedia, GMV is calculated before deductions for costs such as shipping fees, discounts, advertising costs, returns, and other related expenses.

In e-commerce, GMV should be measured at least once annually during a financial period. GMV provides a snapshot of sales activity over a given time frame, without considering any deductions.

While it is a common metric, GMV is especially relevant to e-commerce businesses. This is because such platforms offer the ability to easily track transactions over monthly, quarterly, or yearly periods in detailed fashion.

Also read: Inventory Management Tips for Wholesalers

GMV vs. Net Revenue

It is essential to understand that GMV is the total value of gross sales during a specific period. This figure has not been reduced by returns, discounts, or other costs. GMV simply indicates the volume of transactions.

On the other hand, net revenue is the actual amount of money that enters the business after deductions for shipping fees, discounts, and returns. Net revenue more accurately reflects the true income generated from sales.

For example, if a business sells 1,000 units of pots at RM200 each:

- GMV = 1,000 x RM200 = RM200,000 However, if there are returns, discounts, and additional costs amounting to RM20,000

- Net Revenue = RM200,000 – RM20,000 = RM180,000

Thus, GMV shows the volume of transactions, while net revenue shows the actual income generated.

How to Calculate Gross Merchandise Value in Business

Calculating GMV is straightforward. It is based on the total number of products sold multiplied by the price of each product during a specific period.

Formula for GMV: GMV = Sale Price per Item x Quantity Sold

Example Calculation: Suppose you sell 2,000 suits at RM500 each on an e-commerce platform. The GMV calculation is: GMV = RM500 x 2,000 = RM1,000,000 This calculation does not account for discounts, returns, or other expenses such as shipping and taxes. Therefore, GMV only represents the total value of gross transactions, not the actual revenue the business receives.

There are two main factors that influence GMV:

- The sale price of the goods.

- The number of items sold.

Factors Influencing GMV Value

Although there are two main factors in GMV calculation—the sale price and quantity sold—several other aspects affect these numbers.

The sale price often reflects production costs, raw material prices, operational costs, and profit margins. Changes in any of these elements can directly impact the price of products and indirectly influence GMV.

Meanwhile, the number of products sold is influenced by various external factors such as:

- Marketing and promotional strategies

- Market trends and consumer behavior

- Seasonal events or specific moments (e.g., Ramadan or major sales events)

- Competition from similar products in the market

Though the GMV meaning seems simple, it is tied to multiple business drivers that need close monitoring.

Gross GMV vs. Net GMV in Financial Statements

In financial reports, GMV meaning is classified into two categories: Gross GMV and Net GMV.

- Gross GMV: This is the total value of transactions without any deductions. It includes all sales, even those made by third parties such as resellers or affiliates. Gross GMV provides an overview of sales activity on a platform.

- Net GMV: This is the GMV value after deductions for discounts, returns, refunds, and marketing costs. It offers a more realistic picture of a business’s financial status, particularly in e-commerce channels.

Both types of GMV are important in financial reports. However, for a more accurate performance analysis, businesses often use Net GMV as the primary reference for evaluating strategies and planning ahead.

Also read: Actionable Online Marketing Tips for SMEs in 2021

Why GMV is Important for Businesses and Companies

The GMV figure shows the value of transactions recorded by businesses in the e-commerce sector over a given period. Comparing GMV across time frames can provide insights into overall business growth.

The higher the GMV, the greater the volume of transactions, typically signalling improvements in sales performance, successful marketing campaigns, or effective distribution channel expansion.

However, it’s important to note that GMV is not an indicator of profitability. An increase in GMV should be examined further, such as comparing it with marketing expenses, return rates, and profit margins. This helps avoid misleading assumptions about the company’s financial health.

Benefits of GMV for Businesses: Attracting Investors and Business Valuation

Understanding the GMV meaning gives you access to five key benefits:

- It provides a quick overview of performance during a specific time period.

- It helps inform pricing decisions and ongoing strategies.

- It aids in identifying trends during each time frame.

- It attracts investors as GMV is an indicator of business growth potential.

- It forms the basis for setting sales targets in strategic analysis.

When GMV continues to rise, it can act as a magnet for investors. Essentially, continuous growth signals a company’s potential to scale within its sector, making it easier to attract investors to inject additional capital into the business.

Understanding the Link Between GMV, CLV, and AOV in Business Growth

In business analysis, GMV alone is not enough. To gain a more comprehensive understanding, it’s important to consider other metrics such as CLV (Customer Lifetime Value) and AOV (Average Order Value).

- CLV shows the total value generated by a customer over their lifecycle with the business. This metric is essential for understanding the long-term contribution of customers to revenue.

- AOV reflects the average value of each transaction or purchase made by a customer. AOV is useful for measuring the effectiveness of sales and pricing strategies.

These three metrics complement each other:

- GMV shows the total volume of transactions within a set period.

- CLV focuses on the long-term value of customers.

- AOV helps understand the average transaction value per order.

Ideally, an increase in GMV should also correlate with an increase in AOV and CLV. If only GMV rises, but CLV stagnates or AOV declines, it suggests potential issues with customer loyalty or product bundling strategies.

The Pros and Cons of GMV as a Business Metric

GMV calculations should not be the sole reference point for monitoring business development and financial health. While GMV has advantages, it also comes with limitations.

Advantages:

- Provides a quick and concise illustration of business growth potential.

- Useful for comparison between companies in the same industry or against competitors.

- Easy to calculate and comprehend for most people.

Limitations:

- Does not account for operational costs and profitability in full.

- Does not reflect profit margins or business efficiency.

- Can be misleading if used in isolation without considering other factors.

Thus, GMV is a supporting metric for strategic business calculations related to growth and development potential. However, it should not be the only measuring tool, as it represents raw data that requires further analysis for a more comprehensive understanding.

4 Strategies to Boost GMV in E-Commerce Businesses

There are four strategies you can employ to increase GMV in your business:

- Increase Sales Volume: This can be done by attracting more customers with effective digital marketing strategies and streamlining the transaction process to avoid customer drop-off during purchase.

- Optimise Pricing and Promotions: You can use pricing strategies like discounts, bundling, upselling, and cross-selling to increase transactions.

- Expand Market Reach: Expanding into new marketplaces or international markets can broaden your customer base. With the power of technology, you can reach a global market more easily.

- Improve Customer Retention: Implementing loyalty programs can help retain existing customers, as repeat purchases significantly contribute to increased GMV.

Also read: Traditional Food in Malaysia: Culinary Heritage with Business Potential

Comparing GMV with Other Business Metrics

It’s essential to understand how GMV compares with other commonly used business metrics when analysing sales performance.

- GMV vs. Revenue: GMV reflects the total value of sales without deductions, while revenue shows the actual income after adjustments for discounts, returns, and third-party fees.

- GMV vs. Profitability: Profitability measures net profit after all costs, while GMV simply shows the gross sales value. An increase in GMV doesn’t necessarily mean profitability has increased.

- GMV vs. Customer Acquisition Cost (CAC) & Conversion Rate: CAC tracks the cost to acquire a new customer, and conversion rate measures the percentage of prospects who make a purchase. While GMV, CAC, and conversion rate are related, each measures a different aspect of business performance.

Optimising GMV with the Right Digital Support

In today’s digital-first trade environment, especially in growing markets like Malaysia, understanding the GMV meaning is essential for any B2B player. Whether you’re managing an e-commerce storefront, supplying goods to retailers, or exploring cross-border opportunities, GMV offers a clear snapshot of your transaction scale.

If you are a business owner in the F&B or retail sectors, Borong Market can help optimise your GMV. With our B2B platform, you can manage raw material and product needs more efficiently, while monitoring sales data in real-time.

Not only can you boost GMV, but you can also ensure sustainable profitability. Join Borong Market and elevate your business to the next level!